In the traditional finance world, dollar-cost averaging (DCA) is a time-honored investment strategy that involves purchasing set amounts of stock at regular intervals, whether the price is high or low. This strategy allows you to reduce your average purchase price on the shares. It’s also a good way to take some of the emotion out of investment decisions, and provides opportunities for greater returns over time. But how does dollar-cost averaging apply to crypto assets? Let’s take a look.

What is dollar-cost averaging in crypto?

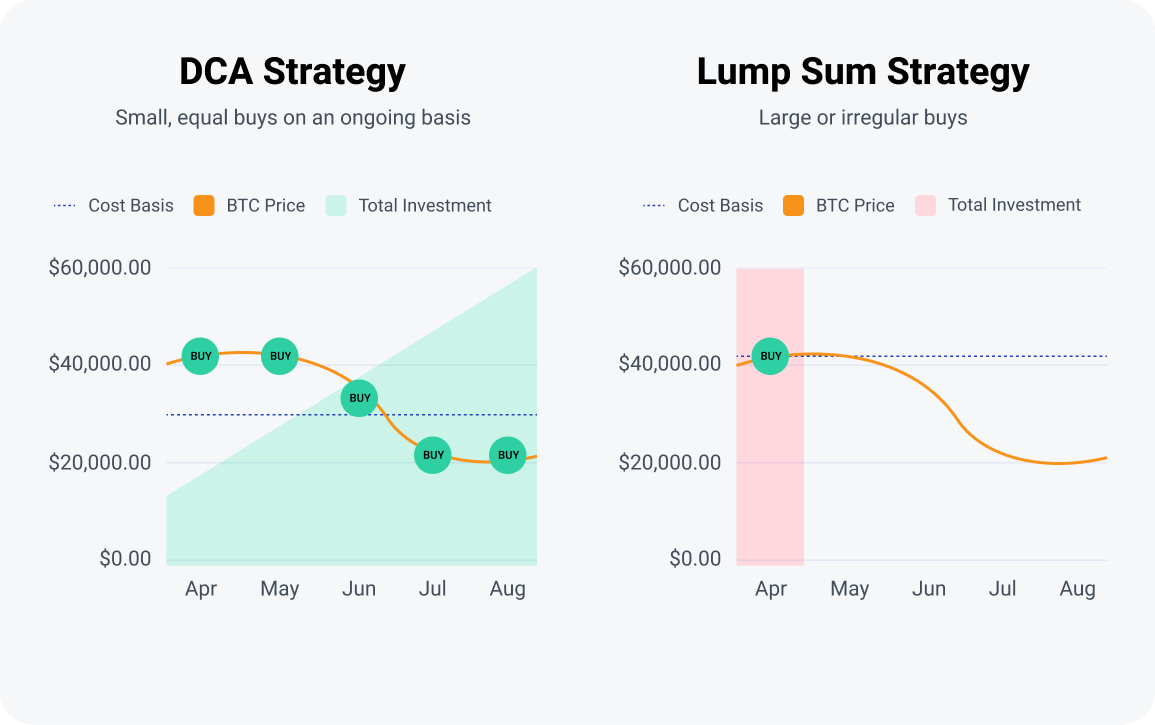

Dollar-cost averaging (DCA) means making smaller, equal investments on an ongoing basis, instead of making large or irregular crypto buys. Although cryptocurrency can be considerably more volatile than stocks, dollar-cost averaging with crypto can help you reap many of the same rewards traditional equities traders enjoy through the strategy. By regularly buying your favorite coins, you’ll be automatically investing more over time no matter what’s going on in the crypto market. This enables you to grow your holdings, and can lower your overall cost-basis during dips.

🧠

Quick reminder: The cost basis is the cost of an asset when you make your purchase. If you buy 1 Bitcoin when it equals $50,000, your cost basis is $50,000.

How does dollar-cost averaging with crypto work?

Let’s say you have $50,000 you’d like to invest in cryptocurrency. If the price of Bitcoin was currently $50,000 and you made a lump sump investment right now, you’d have one Bitcoin at a cost basis of $50,000. However, if you spread that $50,000 across five equal $10,000 buys at a cost of $50,000/BTC, $45,000/BTC, $25,000/BTC, $25,000/BTC and $55,000/BTC then your average cost basis would be $40,000, and you’d have 1.4 Bitcoin. When Bitcoin’s price goes back up, your gains will be magnified because you lowered the average cost to acquire your holdings. With dollar-cost averaging crypto you’ll be acquiring more Bitcoin even during ups and downs.

How to DCA crypto

Are you ready to try dollar-cost averaging with crypto? While the overall idea of regular buys remains true, there are a few other things to consider before jumping in. Here’s how to DCA crypto like a pro:

- Choose the assets you’ll be buying

- Decide how often you’ll make your buys

- Set a rough amount of money you’ll be investing

- Choose a trustworthy provider/exchange you’ll use to make investments

- Select a secure, convenient place where you’ll store and manage your investment

Decide on the token/cryptocurrency you’ll be buying

If you’re looking to start dollar-cost averaging on future purchases of cryptocurrencies you already own, you likely already know what coins you’ll be targeting. If you’re new to crypto, it’s wise to conduct thorough due diligence on any token you’re thinking about acquiring, especially before trying your hand at dollar-cost averaging.

How often will you invest?

Many exchanges offer the option to make automatic purchases monthly, weekly or even daily in some cases. Daily or weekly recurring purchases don’t make as much sense for slower-moving assets like traditional securities, but crypto’s volatility means you can feasibly utilize a DCA strategy with greater frequency than you would when buying stock. As always, be sure the money you earmark for investing is not needed to keep a roof over your head or pay your bills (unless you’re paying bills with crypto).

How much will you invest?

All investing involves risk, but given the crypto market’s potential for extreme volatility, you should only invest money you can afford to lose. Dig into your monthly budget to determine how much in discretionary income you have to commit to investing and avoid exceeding that figure.

Where will you make your buys?

Several trading exchanges offer recurring buys which can be convenient. However, convenience comes at a cost. Exchanges won’t always have the best rates and can add costly fees on top of each buy. Regularly check rates to see where you are able to get the best price. BitPay offers crypto buys with no hidden fees and shows multiple offers to make sure you get the best rate.

Where will you store your investment?

Deciding where you’ll keep your crypto holdings safe and sound is a personal decision. There are many different types of crypto wallets. If you’re using a custodial crypto wallet, be sure it’s got a solid reputation and an established security track record. For more advanced users who are choosing to self-custody, there are many crypto wallets to choose from, including the BitPay Wallet. Not only does the BitPay Wallet offer market-leading security features like self-custody, biometric security, multisig and key encryption to keep your funds safe, it also opens the door to a diverse ecosystem of BitPay products and services to help you get more utility from your holdings. Buy and swap the most popular coins with BitPay to assist in your DCA crypto strategy.

Kick off your DCA strategy with BitPay

Buy Crypto with No Hidden Fees

DCA vs. lump-sum investing

Whenever you put a single lump-sum of money into an investment, the value of your holdings is pegged exclusively to the ups and downs of its share price (or coin price, in the case of cryptocurrency).. By employing a dollar-cost averaging strategy, however, you can flatten out some of the price volatility over time by making additional purchases during market downturns. As of 2022, we’re in the midst of another crypto winter which means asset prices are depressed. Dollar-cost averaging strategy can be especially lucrative during these market conditions.

Potential drawbacks of DCA crypto investing

Of course, there are no completely foolproof investment strategies, and dollar-cost averaging crypto can carry some disadvantages and risks. Automatically purchasing crypto at set intervals means you could spend more money for smaller amounts of crypto if the market goes up sharply. This has the opposite intended effect of DCA, and can actually raise your cost-basis if numerous recurring purchases occur after a major upswing. Some traders favor lump-sum investing during market downturns hoping for bigger gains, but actually achieving those gains requires successfully timing the market, which is very hard to do when you’re competing against automated and/or institutional traders.

Is a DCA crypto strategy right for me?

Using a dollar-cost average in crypto is a consistent, simple way to build your portfolio, notably for beginners or those who don’t want to constantly be in front of a screen. If you’d like to invest more in crypto, but find yourself in “analysis paralysis”, leveraging DCA tactics can help immediately relieve your anxiety and build a stable portfolio overtime.

FAQs about DCA strategies in crypto

How can dollar cost averaging protect your investments?

By making recurring purchases over time in a set amount, you’re effectively removing all emotion from the investing equation. It can be tempting to yank a lump-sum investment out of the market during a downturn, even if you book a loss as a result. But this could cost you big time gains if the crypto you purchased comes unexpectedly roaring back to life after you’ve sold all your holdings.

How do you calculate the dollar-cost average?

If you’re not a math whiz, don’t fret. There are many handy DCA calculators out there that let you simply plug in some numbers to figure out how various purchases will affect your cost-basis, including this one from Omni. Technically it’s designed for calculating DCA on stock purchases, but it can just as easily be used for crypto dollar-cost averaging as well.

How long should you use a dollar cost average strategy?

This depends on factors like your investing horizon and financial goals. Ideally a dollar-cost averaging strategy is something you can set and forget, without having to constantly monitor your portfolio. But true dollar-cost averaging typically happens over a lengthy period of time, typically at least 6-12 months. After all, you can’t really average something out with only a few data points.

How often should you use a dollar-cost average crypto strategy?

Dollar-cost averaging doesn’t have to be the entirety of your crypto investing strategy. Some investors may use DCA for a portion of their holdings even if the bulk of their purchases are made in lump sums.

Is lump-sum investing better than dollar cost averaging for crypto?

There are benefits and drawbacks to both strategies. Lump-sum investing gives you a chance to earn outsize profits when a company’s share price rebounds sharply after a dip, but determining the market’s bottom or predicting where a stock will be in a few months or years is virtually impossible to determine. That goes double for crypto investing, where prices are not only more volatile than stocks, but can be impacted by a wide range of external, unpredictable factors. Your risk tolerance as well as your commitment to your long-term investment plan will determine which method is right for you.

Note: All information in this article is for educational purposes only, and shouldn’t be interpreted as investment advice. BitPay is not liable for any errors, omissions or inaccuracies. The opinions expressed are solely those of the author, and do not reflect views of BitPay or its management. For investment or financial guidance, a professional should be consulted.